BC assessments are out, and on average, Kamloops has seen a 2% decrease to the average property homeowner. But as with any average, it's crucial to understand that individual property assessments may vary. In fact, my own experience with multiple properties shows that some have seen minuscule increases. Let’s explore:

- what the BC assessment is

- why it matters,

- and its significance for buyers, sellers, and real estate agents.

Let's start by defining BC assessment. It's essentially a market evaluation of each property owner's property derived from a specific snapshot in time—July 1st of each year. However, it's important to note that BC assessment's market evaluation is notably different from what a real estate agent would call a market evaluation.

Here is how the BC Assessment and the taxes we pay as property owners all plays out.

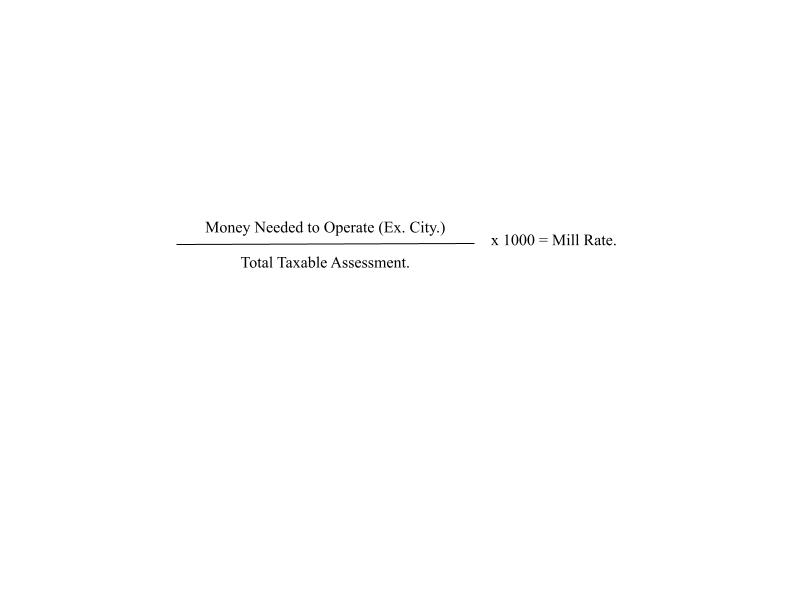

During each municipality's budget process, each city formulates a budget, which they feel they will effectively need to operate the city. The city will divide that amount by the total tax assessment amount of all properties in its jurisdiction. Then that amount is multiplied by 1,000, which comes out to be the mill rate.

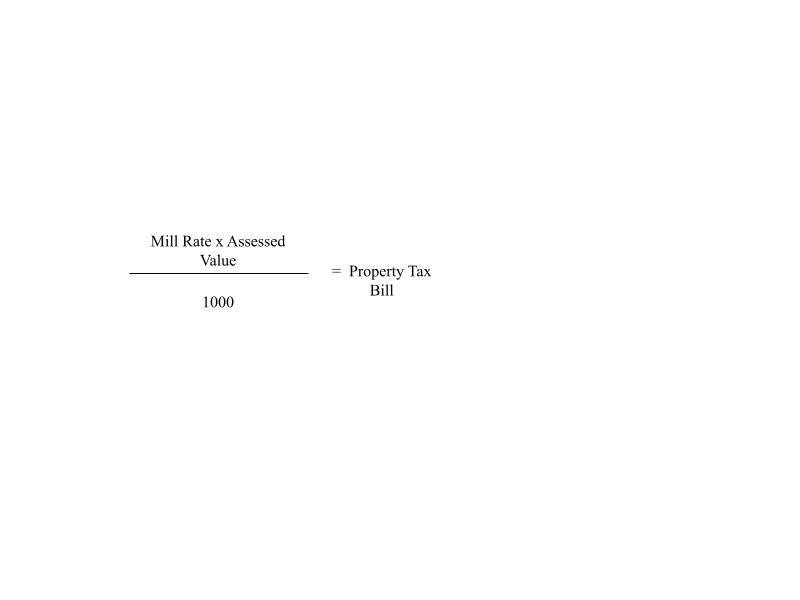

The mill rate is then multiplied by your property assessment for that tax year, which is then divided by 1000 and that is equal to your tax bill.

You will pay…

There are different mill rates for different subcomponents of your tax. Ie. Hospitals, schools, districts and a mill rate for BC assessments. Your tax notice will break down different mill rates for different particulars that you have to pay tax on.

From a real estate perspective, understanding BC assessments is vital when evaluating properties. However, it's essential to approach these assessments with a critical eye. Factors such as…

- market conditions

- changes to market conditions throughout the year

- supply and demand

- the interior condition, mechanical make up, and household efficiency

are all crucial considerations that BC assessments do not take into account. While it's possible to dispute the assessment, it's important to weigh the potential impact on your taxes and the market perception of your property.

Remember, you have until the end of January to dispute your property assessments. However, be prepared with a compelling bundle of data to support your case.